Mortgage Composition

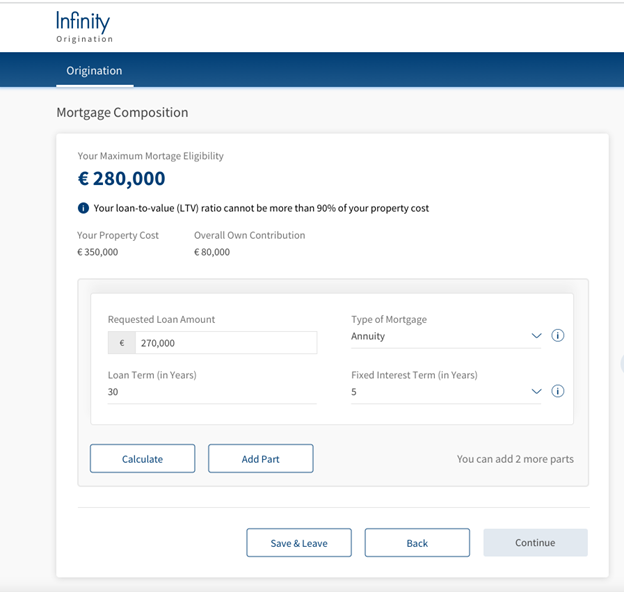

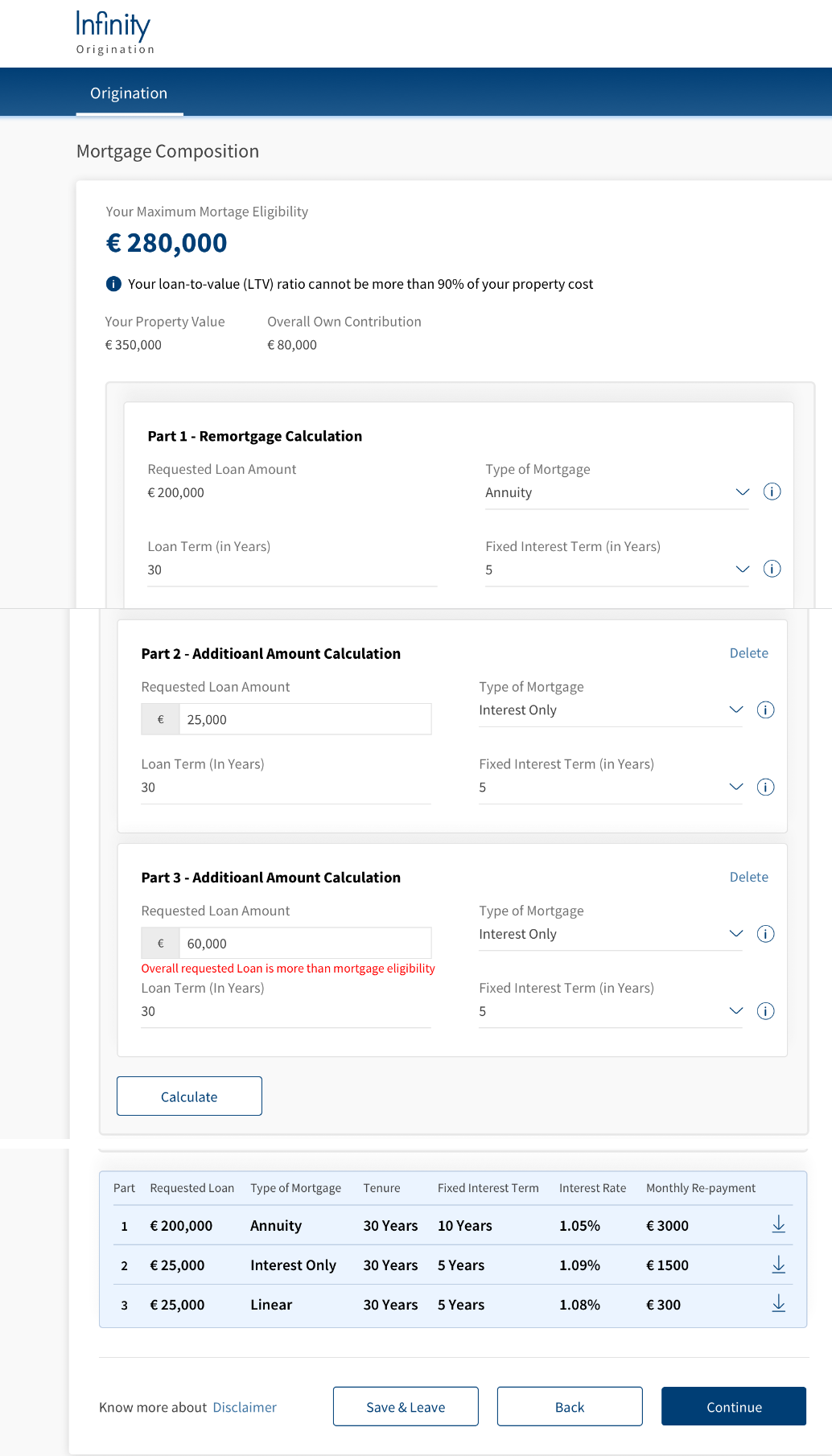

The Mortgage Composition section allows the applicant to add mortgage calculation for mortgage loan in parts and simulate the repayment schedule. Based on the details captured in the Funding Position screen, the requested loan amount is pre-populated in Mortgage Composition screen.

UX Overview

This section provides an overview of the Mortgage Composition details for Mortgage loan- First Time Buyer.

Mortgage Composition screen is applicable for Mortgage loan (First Time Buyer) and Remortgage loan.

MortgageCompositionDetails

The Mortgage Composition screen displays the Maximum Mortgage Eligibility amount based on the details provided in the Funding Position screen. Help Icon displays beneath the Max Mortgage Eligibility amount as the Loan to Value (LTV) ratio cannot be more than 90% of the property cost which is configurable.

Property Value: Pre-populates from the Property Details screen. Applicant cannot edit this field and has to click the Back button to navigate to the Property Details screen if there are any changes to be made in the Cost of Property, for it to be updated and reflects in the Mortgage Composition screen.

Overall Own Contribution: Pre-populates from the down payment amount contributed by the Applicant from the Funding Screen. Down Payment value is calculated as [Customer Contribution (Primary applicant) + Customer Contribution co-applicant + other sources].

The Mortgage Composition screen has the following drop-down and input fields:

- Requested Loan Amount: It pre-populates from the Funding Position screen, based on the value that the applicant has provided and this field is non-editable. When the applicant edits the Requested Loan Amount, it must not exceed the maximum eligible amount.

- When applicant edits the Requested loan amount and if it exceeds the maximum eligible amount, an error message displays as Requested amount cannot be greater than the Maximum eligible amount.

- Type of Mortgage: This section displays the different types of mortgage with the following drop-down options:

- Annuity Mortgage

- Linear Mortgage

- Interest Only Mortgage

Each mortgage type is associated with a product and the corresponding product group is defined in Spotlight Configuration.

Below parameters and values are configured to determine the eligible Loan Term based on the age of the applicant applying for Mortgage First Time Buyer Loan. Below values are configurable via Spotlight as required by each bank.

- Loan Term (in Years): This section captures the Loan Term in years. The Maximum repayment allowed age value is 70 years.

- The Maximum repayment term value allowed by Bank is 30 years.

- Maximum Allowed Repayment Term is calculated using the formula, (n) - Minimum (Bank allowed maximum repayment term, (Maximum allowed Repayment age - Current age)).

- In case of Joint Applicants, take the applicant that has minimum( Maximum allowed Repayment age - Current age).

- The Loan term for each Mortgage must not be greater than the maximum mortgage term calculated.

Value entered in Loan Term, must be numeric and in 2 digits without decimals.

- Fixed Interest Term(in Years): This section captures the Fixed interest term in Period until which applicant wants Fixed Interest rate for Mortgage loan/part. Value entered in Fixed Interest term must be a Numeric field and accepts 2 digits without decimals. Fixed Interest Term must be less than the Loan Term.

Add Multiple Mortgage Parts for Mortgage - First Time Buyer

- To add a new mortgage part for Mortgage loan- First Time Buyer, click Add Part button. You can configure to a maximum of three mortgage parts to the existing mortgage. Post addition of more than one mortgage part, the applicant has the option to delete other mortgage parts.

- Applicant can edit the Loan term in all the mortgage parts and cannot be greater than maximum mortgage part.

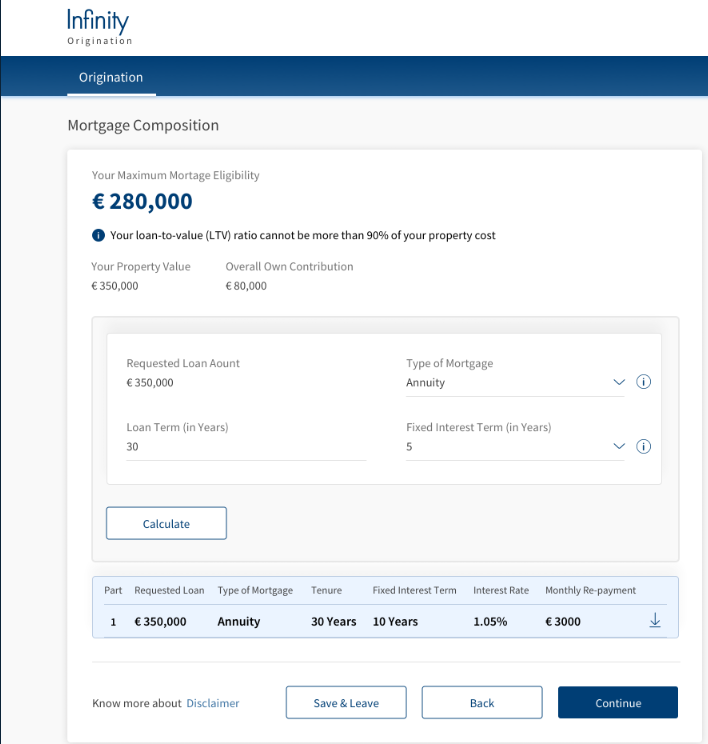

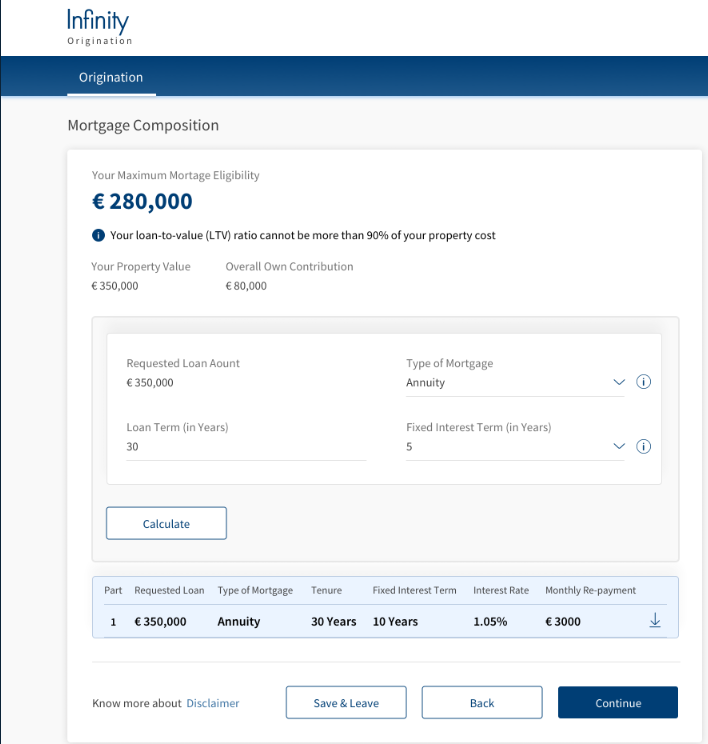

- After adding the required mortgage parts, click Calculate button. Based on the information the applicant provides, Origination App integrates with Transact to fetch the simulation results of repayment schedule. After calculation of the simulation results, Continue button is enabled.

- The correct mortgage product based on the features which you select is configurable in Spotlight Configurations.

- Applicant can view the simulation results along with the repayment schedule. It has the following fields:

- Requested Loan

- Type of Mortgage

- Tenure

- Fixed Interest Term

- Interest Rate

- Monthly Re-payment

- A download link is provided beside the Monthly Repayment field. On hovering over the download symbol, a tool tip displays as Click here to download Repayment Schedule. On click of this link, the Repayment Schedule is downloaded.

Simulation results fetched from the core banking system is stored in Origination Data Microservice (ODMS). Post submission, simulation results are moved to OPMS for further processing in Assist.

Configurations

The System administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Funding Position section, click here.

Remortgage Loan

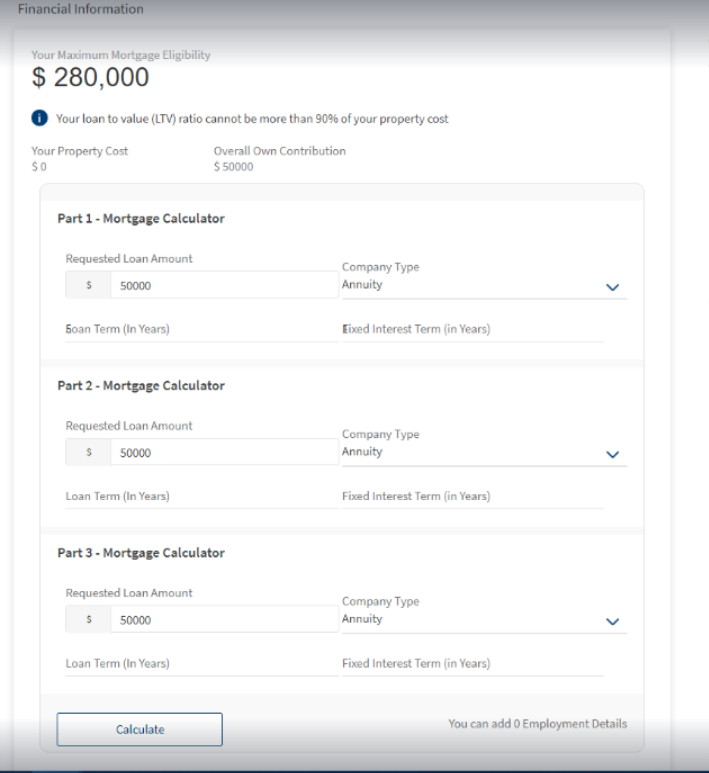

The Mortgage Composition screen for Remortgage Loan allows the applicant to add mortgage calculation in parts and simulate the repayment schedule. Based on the outstanding loan and additional loan details captured in the Remortgage screen, the requested loan amount gets pre-populated in Mortgage Composition screen. Your Maximum Mortgage Eligibility loan value displays at the top of the screen, and this value is not-editable. Help Icon displays beneath the Max Mortgage Eligibility amount as the Loan to Value (LTV) ratio cannot be more than 90% of the property cost .

Property Value: Pre-populates from the Property Details screen. Applicant cannot edit this field and has to click the Back button to navigate to the Property Details screen. If there are any changes to be made in the Cost of Property for it to be updated and reflects in the Mortgage Composition screen.

Overall Own Contribution: Pre-populates from the down payment amount contributed by the Applicant from the Funding Screen. Down Payment value is calculated as [Customer Contribution (Primary applicant) + Customer Contribution co-applicant + other sources].

For Remortgage, if the applicant selects Additional Loan Required as No in the Remortgage details screen then the Requested Loan Amount pre-populates from Outstanding Loan Amount field from Remortgage screen, and this field will be non-editable. Add Part Button will be disabled as multi-parts is not allowed.

For Remortgage, if the applicant selects Additional Loan Required as Yes in the Remortgage Details screen then by default Two parts are displayed. Add Part Button will also be displayed to add another part as additional loan amount can be requested in multipart.

Add Part for Remortgage Loan:

To add part for Remortgage loan, click Add Part button. Applicant can add Additional Loan Amount in 2 parts.

Part 1 displays the Remortgage Calculation. In this card, Requested Loan Amount pre-populates from Outstanding Loan amount field in Remortgage screen and this field is not-editable.

Type of Mortgage drop-down has different types of mortgages with available values as Annuity Mortgage, Linear Mortgage and Interest Only Mortgage.

Below parameters and values are configured to determine the eligible Loan Term based on the age of the applicant applying for Remortgage Loan. Below values are configurable via Spotlight as required by each bank.

Loan Term (in Years): This section captures the Loan Term in years. The Maximum repayment allowed age value is 70 years.

- The Maximum repayment term value allowed by Bank is 30 years.

- Maximum Allowed Repayment Term is calculated using the formula, (n) - Minimum (Bank allowed maximum repayment term, (Maximum allowed Repayment age - Current age)).

- In case of Joint Applicants, take the applicant that has minimum( Maximum allowed Repayment age - Current age).

- The Loan term for each Mortgage must not be greater than the maximum mortgage term calculated.

Fixed Interest Term(in Years): This section captures the Fixed interest term in Period until which applicant wants Fixed Interest rate for Mortgage loan/part. Value entered in Fixed Interest term must be a Numeric field and accepts 2 digits without decimals. Fixed Interest Term must be less than the Loan Term.

Part 2 displays the Additional Amount Calculation. In this card, Requested Loan Amount pre-populates from the Additional Loan amount field in Remortgage screen, and this field is editable. Applicant can further split the Requested Loan amount into two parts (Part 2 and Part 3) and can increase or decrease the loan amount in Part 2 and Part 3 if added. Click Calculate button to view the Repayment details.

System validates to check if the remortgage loan amount which applicant entered in Part 1, Part 2, and Part 3( if added) must not exceed the Maximum Mortgage Eligibility value. If the amount value exceeds the Maximum Mortgage Eligibility, then an error message displays as Overall requested loan is more than mortgage eligibility

A confirmation window displays as Your requested additional Loan Amount is more than Additional Loan Amount in the Remortgage Screen. When applicant clicks Yes, the Additional Loan Amount in Remortgage Screen and Additional Borrowing Amount in Funding Position screen will be updated automatically. When the applicant clicks No, the control remains on the mortgage composition screen. Click Back button to navigate to the previous screen and update the details.

Applicant can view the simulation results for all the Parts with the following fields:

- Requested Loan

- Type of Mortgage

- Tenure

- Fixed Interest Term

- Interest Rate

- Monthly Re-payment

A download link is provided beside the Monthly Repayment field. On hovering over the download symbol, a tool tip displays as Click here to download Repayment Schedule. On click of this link, the Repayment Schedule is downloaded.

Click Continue button, the control navigates to the next screen.

Experience APIs

The following APIs are shipped as part of this feature:

| API | Description |

|---|---|

| getProductSelection | This API allows to get the Product Selection info stored in ODMS. |

| updateProductSelection | This API allows to create/update Product Selection details in ODMS. |

| generateDocument | This API allows to generate the document |

| updatePaymentSchedule | This API allows to update the schedule data in ODMS . |

In this topic